Our ultimate goal with this survey is getting an up to date International churn rate for Netflix’s users, which can be used to determine their customer lifetime value (CLTV). This is the key unreported metric in their SaaS valuation, which appears to be how NFLX trades. CLTV along with the company’s total market opportunity are the key outstanding questions investors appear to have concerning the future stock price.

More specifically the surveys are determining:

a Penetration rate – The percentage of users who have or have had a Netflix subscription over the last 12 months. The market potential is best outlined by our U.S. survey finding that the company has an online penetration rate of 82%. This is important in anticipating the next few quarters net subscriber additions.

an Annual churn rate – The percentage of users who have left Netflix over the last 12 months. In most markets, churn is well above U.S. cable churn of 30%, primarily due to Netflix being in most International markets for a shorter time. The potential upside is seeing U.S. churn of under 20%, which was reached in our last U.S. survey.

Reasons why subscribers left – All users who have left over the past year are categorized by the reason they have left. This includes those leaving Netflix due to costs, lack of enough good content, free-trial period ending, a competing media content solution or password sharing.

Japan and Germany are proxies for Europe and Asia – Japan and Germany are two markets that we believe are good proxies for non-English and non-Spanish speaking European and Asian markets. They are the #3 and #4 economies of the World representing over 10% of the World’s GDP. Europe and Asia represent over 60% of the World’s GDP. Increasing penetration in these regions is key to International growth.

Japan and especially Germany are less penetrated than we thought – The surveys reveal that Netflix is having a hard time penetrating key European and Asian countries, relative to where Mexico penetration is today. Our survey reveal 27% and 28% of online respondents in Germany and Japan respectively have had a Netflix account over the past year. This compares to 66% in Mexico and about 82% in the U.S. as per our surveys in June.

EXHIBIT 1: Penetration Rate vs. Presence in International Markets

Source: Perspectec

Over the next few years, if these key markets follow Mexico and the U.S., we should be seeing a strong, steady increase in penetration. Netflix has a wide variety of country experiences to fall back on. On success story is in Mexico, where in its fourth year in the country, Netflix launched Narcos and Club de Cuervos. These shows grew awareness and loyalty to their subscriber base there, helping to push Mexican penetration higher.

Churn is over 50% in Japan and Germany – Our surveys indicates that churn is 64% in Japan and 52% in Germany. These rates are significantly higher than the 17.5% churn we found in the U.S. and 23% in Mexico.

EXHIBIT 2: Churn Rate vs. Presence in International Markets

Source: Perspectec

Google trends is misleading – Google trends show Netflix as being more popular in Germany than in Japan, which is not true. This is likely a reflection of Google being less popular in Japan than in Germany. Beware that Google Trends is not a good source for doing country comparisons.

Price and content are the primary reason for the high churn – The reasons for churn in Germany were:

- The service was too expensive

- The content got boring

- The free-trial ended

- The subscriber moved to another platform

For Japan, those reasons were:

- The free-trial ended

- The content got boring

- The service was too expensive

- The subscriber moved to another platform

EXHIBIT 3: Germany survey results

Source: Perspectec

EXHIBIT 4: Japan survey results

Source: Perspectec

Local language shows matter – In International markets where English is not widely spoken, local language content is what fuels subscription growth. As of July 31st, 2017, Netflix has released only one original program (a stand-up) and four acquired shows in German, with two German original dramas scheduled for the end of the year. Despite a lower penetration rate, Japanese language content appears more abundant, with 8 originals series, 1 original movie, 11 acquired shows and 4 series slated for the end of 2017. This would explain the higher market penetration in Japan despite Netflix launching a year earlier in Germany.

Netflix’s primary International strategy will be to reduce churn in developed markets – With annual churn rates well above 50% in Germany and Japan, the easiest path to improving Netflix valuation is to keep existing subscribers from leaving. Netflix will have to invest heavily in local language content, especially in markets where they face relatively lower competition from Amazon and local SVOD providers (Japan being one of those countries). How these local language programs do in 2017 will determine subscriber churn, net subscriber additions and the future share price.

Easiest strategies involve a lower RoI – With smaller populations and having started later, the RoI in non-English and non-Spanish markets for Netflix will be lower than it has been in the past. By starting later, the market has opened up the World to more online content competition, most notably from Amazon Prime.

With a Net Debt / trailing 12-month EBITDA of 3x and negative free cash flow of $2 billion a year, Netflix needs to sharpen its focus in these smaller markets. Bad decisions will manifest into shareholder dilution when the company reaches its borrowing limits on low cost U.S. debt by next year.

Competition is more of a concern in many International markets – The market penetration data also reveals the presence of alternative (and cheaper) sources of SVOD services. Amazon is consistently undercutting Netflix’s price. Price remains the number one source of churn and perhaps as a result, Amazon has a larger market share in both the markets we surveyed.

What this means for our model and estimates – Based on the churn rates in Mexico, Japan and Germany, we are estimating churn in international markets to be about 45% and for Netflix’s overall churn to be about 31%. This is very close to the churn rate that cable companies are thought to generally see (30%).

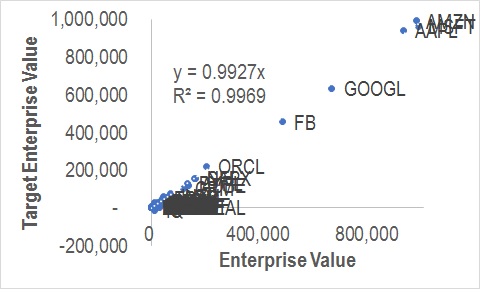

Using our updated churn statistics and Q2 2017 financials, we have updated our SaaS metrics and show what it means to relative valuation below:

Using our updated churn statistics and Q2 2017 financials, we have updated our SaaS metrics and show what it means to relative valuation below:

EXHIBIT 5: Comparison of SaaS metrics for Netflix and its peers

Source: Company reports, Perspectec

SaaS metrics remain a little worrisome – We focus on customer growth costs (CGC, S&M and R&D) rather than customer acquisition costs (CAC) as R&D investment is critical to continued subscriber retention and growth. CLTV / CGC is down from 1.6x in Q1 to 1.2x in Q2. This decline is something to watch as it implies they are only generating 20% margins on the costs to sell and grow their platform.

Important Disclosures and Disclaimer

This publication is produced by Perspectec Inc. This publication and the contents hereof are intended for information purposes only, and may be subject to change without further notice. Any use, disclosure,

distribution, dissemination, copying, printing or reliance on this publication for any other purpose without our prior consent or approval is strictly prohibited. Neither Perspectec Inc. nor any of its respective parent, holding, subsidiaries or affiliates, nor any of its respective directors, officers, independent contractors, servants and employees, represent nor warrant the accuracy or completeness of the information contained herein or as to the existence of other facts which might be significant, and will not accept any responsibility or liability whatsoever for any use of or reliance upon this publication or any of the contents hereof.

No publications, nor any content hereof, constitute, or are to be construed as, an offer or solicitation of an offer to buy or sell any of the securities or investments.

This research report is not to be relied upon by any person in making any investment decision or otherwise advising with respect to, or dealing in, the securities mentioned, as it does not take into account the specific investment objectives, financial situation and particular needs of any person. Please refer to Persepctec Inc.’s terms of use disclosure and privacy policy https://perspectec.com/term_of_use

|

RATING |

CURRENT RATING |

PREVIOUS RATING |

|

BUY |

|

|

|

HOLD/NEUTRAL |

✓ |

✓ |

|

SELL |

|

|

For the purposes of complying with NYSE, NASDAQ and all Self-Regulatory Organizations, Perspectec Inc. has assigned the following rating system BUY, HOLD/NEUTRAL, SELL for the securities which are the views expressed by an analyst, Independent contractor, and or an employee of Perspectec Inc. The information and opinions in these reports were prepared by Perspectec Inc. or an analyst, independent contractor. Though the information herein is believed to be reliable and has been obtained from public sources believed to be reliable. Perspectec Inc. makes no representation as to its accuracy or completeness.