Calling institutional investors on a sunny Friday afternoon before the Labo(u)r Day long weekend proved mostly fruitless for myself and Perspectec’s associates in Toronto. However, I’ve received a few inbound questions and points on our 55-slide presentation. As a result, we have updated and slightly re-ordered our Lightspeed investor deck while adding an additional five slides (39, 42, 48, 50, 51).

The primary questions via email were around valuation, the math, and logic behind it. As a result, we have added additional math for both Shopify and Lightspeed’s as well as some logic to using LTV/GC as a multiplier to our valuation. This is something we have done in the past with media streaming and has proven to work well. Among the updates we made was a correction to a formula that was shown to add gross margin from non-recurring gross margin to the denominator of growth costs. While our math in our formulas was correct, it should have shown as a deduction.

Finally, we show August 28th, 2019 quotes from both Nutanix’s and Box’s CEO’s, who are now putting lifetime value metrics as their focus despite in Nutanix’s case having seen capital expenditures of over $60 million last year.

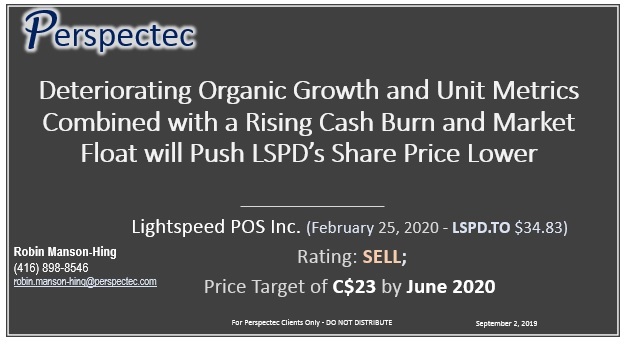

Lightspeed – SELL – September 2, 2019 – Perspectec

On a side-note, there are large swaths of U.S. institutional investors who follow SaaS valuation metrics closely. Canadian institutions have proven to be more hesitant, despite understanding lifetime value metrics and their importance in company strategy and acquisitions. A Canadian investor’s ability to get more comfortable with these metrics will be key to a larger number and high-quality IPOs listing in Toronto. I believe it is important that we don’t let an early run-up and likely subsequent fall in LSPD’s share price scare off future funding for the likes of a Freshbooks, TouchBistro, Klipfolio and other great Canadian technology companies.