Aphria is in the midst of building out its largest and likely last greenhouse expansion (Part IV). Their 700,000 square-foot expansion will increase cannabis production capacity from 30,000 KG a year to 100,000 KGs when it is finished by mid-2018. Talking with insiders at the company, material technological advancements are poised to have a meaningful impact to the future operational costs and profits of Aphria.

Among the changes the additions to includes:

1) The co-generation of heat and power (CHP) in the new building,

2) Power supply from the proposed Windsor-Essex upgraded grid, and potential sell back

3) Switching to LED lightning (provided by LumiGrow) for the entire building

These solutions are expected to reduce the power requirements from 15 megawatts (MW) in the new Part IV greenhouse to roughly 6 MW. For comparison purposes, a 100 meter wind turbine produces about 2 MWs.

We see the savings in power and labor costs leading to materially lower cash cost per gram. Further details will be revealed in conjunction with Part IV greenhouse results reported after their release of Q4/19 results.

Big Greenhouses are following Aphria’s lead – Licensed producers (LPs) are increasingly gravitating towards greenhouses, and large ones at that. Late last year, Aurora Cannabis began construction their $110 million, 800,000-square-foot hybrid-greenhouse called their Aurora Sky project. Quebec’s only LP, Hydropothecary, is in the process of starting construction of a 250,000-square-foot greenhouse. Canopy Growth on the other hand has its intention to acquire a 100,000-square-foot facility in New Brunswick

Aphria remains ahead of the pack in terms of profitability – Despite the increasing competition from large greenhouses, Aphria’s management team appears a step ahead of these competitors. Some of the reason why include:

1) Best in class cost of capital – The company has $167 million in cash and $32 million in debt with $140 million in capital expenditures forecast by us over the next five quarters before completing the phase 4 expansion. Their most recent $100 million raise (75% equity / 25% Debt) occurred at a cost of capital of 7.4%, This compares to Aurora at over 13% with their most recent equity raise of only $75 million. If Canopy were to raise this amount of money, their cost of capital would have been just above Aphria’s in the high 7% range. Today given Aphria’s positive EBITDA, their ability to raiase debt means their cost of capital for sub-$100 million raises can be expected to be somewhat lower than Canopy Growth’s.

2) Experience on execution – As most who follow the company know, Aphria has a dearth of experience (a combined 55 years of agriculture-business experience). Being located in the Southern most city in Canada and with years of experience producing thousands of kilograms of cannabis in an actual greenhouse, Aphria has an advantage unlike most competitors and the lack of experience with large scale indoor greenhouse growing operations.

Details on Aphria’s expansion – The new building is a Dutch style greenhouses with 230,000-square-feet of infrastructure which include new Level 9 vaults, processing areas, warehouse facilities, automation of grading and sorting in the phase 3 and 4 parts of the facility, and security consistent with ACMPR standards. But, what we consider a strong addition is Aphria’s power and heat co-generation initiative.

Source: Perspectec

CHP is more efficient than what other LPs are using – CHP is an efficient way of using natural gas in the greenhouse. CHP is an on-site integrated energy system that generates both electricity and thermal energy. It requires less fuel to produce the same output as conventional systems installed by other LPs. According to the U.S. Environmental Protection Agency (EPA), this method is 47% more efficient than power from the grid and heat from boilers. CHP also provides a reliable backup during emergencies by isolating from the grid and delivers reliable power without on-site fuel storage.

Impact – To understand the financial impact of this technology, a mere 0.7 MW CHP system can save a facility upwards of $1 million in yearly operating costs. The only other LP undertaking the CHP initiative is Maricann and they are on track to meet their cost objective of less than $1.34 per gram produced. This would position them amongst the lowest cost producers in Canada. a title Aphria currently holds with cost per gram at $1.11 ($0.79 by most competitors’ definition). Below is a schematic of what is involved in the CHP process.

Source: Clarke Energy

Cultivation requires high energy consumption and costs – Aphria becoming self-reliant with CHP is a big step towards achieving lower costs. CHP systems are ideal for cannabis growing since it requires a massive and constant electricity load and a proportionate amount of cooling, heating and ventilation to properly maintain an optimal growing environment. Below is the break down of energy consumption of the average indoor cannabis cultivation facility and the average energy cost as a % of wholesale price. Aphria aims to dominate in the wholesale market where prices are key so through initiatives like CHP, electrical costs can be cut and saved to ensure goals are met.

Source: California Public Utilities Commission – Policy and Planning Division

CHP System versus a Traditional System

Source: Cummins Inc

Hydro One may have trouble supplying Part IV all the power – The CHP initiative is also a reasonable strategy because of the existing issues in Leamington, Ontario and current power grid supply. Essex Power Corporation, one of the power suppliers in the region, is wholly owned by a number of towns including the Municipality of Leamington. Essex services some but not all customers within the Windsor-Essex region; Hydro One also supplies parts of the region, mostly rural area networks. Aphria currently get their electricity from Hydro One, but fears are that Hydro One will not be able to supply the entire 15 MW power needed once Part IV is online.

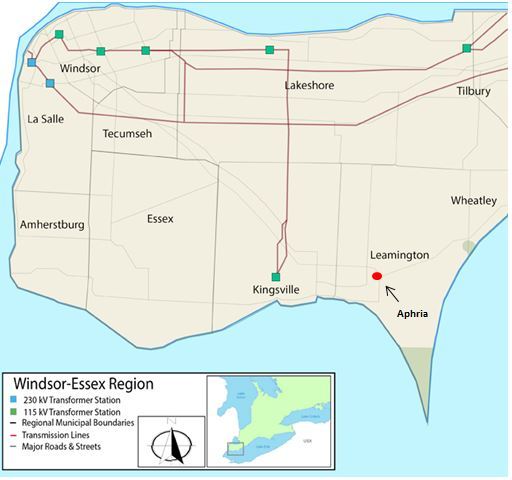

The figure below depicts the current grid situation in the Windsor-Essex region. A lack of transmission lines in Leamington and the previous loss of two 230 kV circuits in the area potentially means the remaining transmission lines could be inadequate to meet power demands from greenhouse operators.

Source: Hydro One

Upgraded grid supply and surplus flow back – There are some important points to be aware of. Ontario in conjunction with Hydro One has been working on making upgrades in the region, (expected to be operational in the summer of 2018 or sooner). Aphria’s CEO Vic Neufeld’s sits on the board of EnWin Energy – a local distribution company in Windsor. It appears Aphria will be able to negotiate to have some power supplied to them at a low cost by either the Province or the City of Leamington through potential power surplus flowback. The rest according to sources at Aphria will be through their own CHP approach.

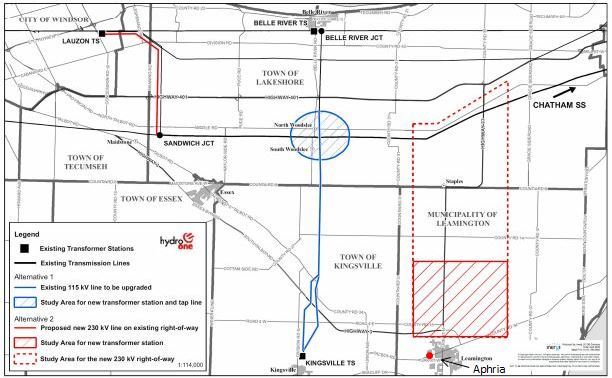

One of the options for upgrades from the Province is a new 230 kV transformer station in the Leamington area and associated “tap” line to connect it to the provincial grid. This is shown in the figure below. We believe the Province’s upgrades will give them the capability to supply some power to Aphria which should downsize the Part IV project from 15 WW by at least 3 – 4 MW.

Long-run options are good – In the long run, given the Canadian Government’s (Natural Resources Canada) policy of excess power from CHP “potentially be sold back to the grid”, Aphria could flow back any surplus electricity to the grid for a source of income. Another option is returning power from the Province at a cheaper cost than the market.

Proposal for Transformer

Source: Hydro One

LED lights are more efficient than traditional HPS lights – Aphria’s decision to add LED lights to their operations appears driven by the reduction of costs in combination with quality/output increases. While initial costs of LEDs are high, some greenhouses have seen savings of up to $45,000 a year on their energy bills. This is due to the fact that LED lights are much more efficient at converting watts into light and therefore require 60% to 90% less energy than traditional high-pressure sodium or metal-halide lights. The light emitted by LED lights is also materially cooler and therefore does not require added ventilation equipment and can target portions of the light spectrum that have proved most beneficial to cultivation. Aphria have a focus on red and blue spectrums since the sun acts as the main source of lighting in the greenhouses so they do not need to use full-spectrum lights. We believe the installation of LED lights will allow for an additional 4 – 5 MW of power savings from Part IV’s proposed 15 MW which will bring the total downsized power demand of Part IV to roughly 6 MW.

Aphria chose LumiGrow Inc – a U.S. based smart horticultural lighting provider- as their LED solutions. One of the pieces of technology Aphria will have in the new greenhouses is the LumiGrow smartPARTM Wireless Control System. This will allow Aphria to control LumiGrow LEDs from a mobile device remotely. Aphria will be able to easily adjust lighting strategies, use white light view-mode for crop inspection, and implement LumiGrow’s adjustable spectrum to boost terpenes and elicit other desired crop characteristics. All of this controlled from a mobile device.

The greenhouse is expected to save the company 9 or 10 cents a kWh. It is only in these high-tech systems that a LP is going to get the quality and yield at the lowest operating cost.

Important Disclosures and Disclaimer

This publication is produced by Perspectec Inc. This publication and the contents hereof are intended for information purposes only, and may be subject to change without further notice. Any use, disclosure,

distribution, dissemination, copying, printing or reliance on this publication for any other purpose without our prior consent or approval is strictly prohibited. Neither Perspectec Inc. nor any of its respective parent, holding, subsidiaries or affiliates, nor any of its respective directors, officers, independent contractors, servants and employees, represent nor warrant the accuracy or completeness of the information contained herein or as to the existence of other facts which might be significant, and will not accept any responsibility or liability whatsoever for any use of or reliance upon this publication or any of the contents hereof.

No publications, nor any content hereof, constitute, or are to be construed as, an offer or solicitation of an offer to buy or sell any of the securities or investments.

This research report is not to be relied upon by any person in making any investment decision or otherwise advising with respect to, or dealing in, the securities mentioned, as it does not take into account the specific investment objectives, financial situation and particular needs of any person. Please refer to Persepctec Inc.’s terms of use disclosure and privacy policy https://perspectec.com/term_of_use

|

RATING |

CURRENT RATING |

PREVIOUS RATING |

|

BUY |

✔ |

✔ |

|

HOLD/NEUTRAL |

||

|

SELL |

For the purposes of complying with NYSE, NASDAQ and all Self-Regulatory Organizations, Perspectec Inc. has assigned the following rating system BUY, HOLD/NEUTRAL, SELL for the securities which are the views expressed by an analyst, Independent contractor, and or an employee of Perspectec Inc. The information and opinions in these reports were prepared by Perspectec Inc. or an analyst, independent contractor. Though the information herein is believed to be reliable and has been obtained from public sources believed to be reliable. Perspectec Inc. makes no representation as to its accuracy or completeness.