Spotify continues to lead the streaming music market, splitting share in North America with its largest competitor, Apple Music. The company’s Q2 results and Q3 guidance raised our prospects on the stock slightly.

More importantly, however, we have updated our valuation metrics on Spotify.

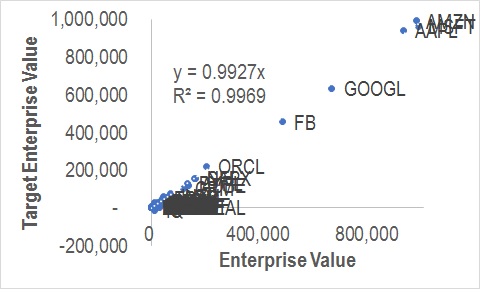

Previously we had valued Spotify on only a trailing 12-month customer lifetime value basis. However, this valuation metric did not do an adequate job accounting for Spotify’s growth metrics. We now value Spotify on a combination of one year’s worth of gross margin dollars and one year’s worth of customer lifetime value added, accounting for guidance one quarter forward. This method gets us to target prices that are generally in-line with where consumer-facing content providers such as Spotify, Netflix, SiriusXM and Dish trade at.

Our updated valuation methodology takes into account Spotify’s Q3 guidance and our forecast. Our target price increases from $104 to $160 using our Q3 forecast. Using trailing 12-month results would have had our target at $145. We believe investors should hold on to Spotify until the share price comes down.

Review of Spotify’s Q2 results and outlook:

Spotify (SPOT – NYSE) reported revenues of €1.273B vs. consensus €1.270B and Perspectec €1.280B. Differences in revenue vs. consensus and our estimates were attributable to slightly higher premium ARPU of €4.89 vs. our estimate of €4.81, offset by slightly lower subscriber count (83m vs Perspectec 84.3m) and advertising revenues of €123m vs Perspectec €130m.

Premium ARPU was €4.89 vs our estimate of €4.81, down 12% Y/Y but up 4% Q/Q with the quarterly €0.17 uptick mostly associated with the promotional pricing runoff from Q4/17 that occurred in the final month of Q1/18. We note this number came in slightly higher than management’s Q1/18 estimate that ARPU would not fluctuate more than €0.15 between quarters during the year.

Our current forecast calls for premium ARPU to decline to €4.73 in Q3/18. This reflects most of the effects of the 99-cent 3-month trials from the end of Q2/18, continued uptake of the Hulu bundle, as well as the growing reliance on lower ARPU Latin American and Rest of World subscribers. We have tweaked our ARPU algorithm slightly to reduce the estimated proportion of family and student plans but increase promotional impacts to better reflect quarterly gyrations. We expect ARPU to come in modestly higher should the US dollar continue to strengthen against the Euro as it did in Q2.

We believe that strength in the premium business mildly offset advertising revenue in the quarter. Management indicated its key advertising markets (due to higher margins) are currently the United States, Canada, Australia, New Zealand, and most of Western Europe. We note that regional top 200 stream count performance, our broadest tracked indicator of subscriptions, performed at or better than our expectations in all these regions. We expect future subscription outperformance in these regions to have a higher negative impact on advertising revenue as sell-through rates are notably worse in emerging markets. We have slightly reduced our advertising revenue forecast and increased our premium revenue forecast to account for this.

Gross margins (25.9%) were stronger than our forecast (24.6%), but not without some strings attached. Management explained this was in part due to gains in accrual adjustments from prior period estimates related to rightsholders liabilities. This was described as “similar” to the 124bps adjustment seen in Q1/18 but not as large in magnitude.

Our Q3/18 gross margin estimate is 25.3% (26% premium, 18.8% advertising), acknowledging a Q/Q decline in margins from trial and promotional activity that is felt in Q3 as well as the reduced impact of beneficial accrual adjustments.

We expect gross margins will continue to trend at the top half of guided ranges whenever subscriber counts come in at the top of guided ranges. We do not believe these beneficial accrual adjustments to rightsholders will persist in the intensity they have during Q1 and to a lesser degree Q2. Royalties paid to rightsholders should roughly mirror stream counts and platform usage over time absent of a new deal with rightsholders.

Gross margin will continue to be heavily anchored to Spotify’s quarterly subscription numbers and churn rate. Minimum guarantees Spotify has made to labels that scale favorably based on the company’s ability to attract and retain subscribers are the primary driver of fluctuation in the premium gross margin outside of less predictable quarterly accrual adjustments to rightsholders.

Operating losses were €90M vs €117.2M estimated. The company realized operating expenses of €419M in the quarter vs €429M estimated, with almost the entirety of the discrepancy coming from G&A (€114.6M est vs. €103M actual). Approximately €17M of the remaining outperformance was due to higher than expected gross margins which were impacted by general performance in subscription metrics and accrual adjustments to rightsholders in the quarter.

Net loss per share was –€2.20, exceeding our estimate of -€0.59. The significant discrepancy in net loss per share in the quarter was due to non-operating finance costs ticking up to €343M from €154M in Q1/18. Management stated on the call that this jump was associated with the effect stock price performance in the quarter had on the revaluation of convertible debt which is now gone as well as other liabilities. EBITDA which excludes finance costs was -€84M vs. -€66.7M est, with the approximately €17M difference attributed to some additional strength in gross margins, as discussed earlier.

Management stated average quarterly churn was roughly 900bps lower Y/Y, bringing it to approximately 5.0% vs 5.9% in the same period last year higher than 4.7% in Q1/18. An uptick in Q2 churn was expected due to Q4/17 trial runoff but came in slightly higher than our 4.8% estimate. Notably, CFO Barry McCarthy exclaimed that churn in the United States had “obtained a 3 handle” and was under 4% in a rebuke of some reports that Spotify was experiencing high levels of US churn resulting from Apple Music competition.

Our initial Q3/18 premium subscriber forecast is 88m vs. 85-88m guidance. We base our current estimate on existing trends in stream counts for Spotify’s top 23 largest smartphone markets with some added benefit from markets launched in the final weeks of Q1/18 and an additional day in the quarter. We anticipate our subscription forecast algorithm will be updated again by the end of Q3/18 to utilize additional data points not present in our Q2/18 forecast.

End of quarter headcount stood at 3,969 vs. our 4,015 est. Changes in headcount are largely being driven by increased R&D spending as the company has previously indicated and we expect this trend to continue.

Exhibit 1: SPOT Financial Forecast

Exhibit 2: SPOT KPI Forecast

July US Consumer Survey

26.6% of US subscription cancellations in the past 3 months were associated with the subscriber moving to a competing streaming music service. This compares with estimates of 18% for Netflix in streaming video.

Spotify can do very little to differentiate with respect to content offering (unlike Netflix) and must justify R&D by producing a better user experience and platform ecosystem. In our view, monitoring the trend in the rate of cancellations associated with switching services provides the most insight into whether Spotify’s declared strategy of higher R&D spending is an effective allocation of capital for subscriber retention after macroeconomic factors and broader competition for entertainment dollars are stripped away.

Exhibit 3: Premium subscription rates remain significantly skewed towards younger demographics

Source: Perspectec

7 years after US launch, there is still a large uncaptured opportunity in older US demographics. 70.7% of respondents in the 45-54 age cohort claim to have no Spotify account at all. Churn characteristics and loyalty were significantly more favorable in this age group with only 13.5% of subscription cancellations in the last 3 months associated with moving to a different streaming service versus 26.6% across all age groups.

Exhibit 4: Older age groups remain underutilized

Source: Perspectec

Updated Valuation and the impact to Other Stocks

Update from Robin Manson-Hing: We also update our target prices for Netflix and Pandora. We also are launching coverage of DISH and SIriusXM in Perspectec’s General Portfolio.

Exhibit 5: Retail Content Providers with a Capital Intensity < 10%

Source: Perspectec

Source: Perspectec

Dish Network (DISH-NASDAQ)

Important Disclosures and Disclaimer

This publication is produced by Perspectec Inc. This publication and the contents hereof are intended for information purposes only and may be subject to change without further notice. Any use, disclosure,

You must be logged in as a 'Perspectec Institutional Equity Research' or 'Perspective on Technology' subscriber to view this content.